Treasury investors anticipate Fed shift back to growth risks.

Investors in US government bonds are starting to bet the Federal Reserve will soon need to pivot from worrying about sticky inflation to fretting about slowing economic growth.

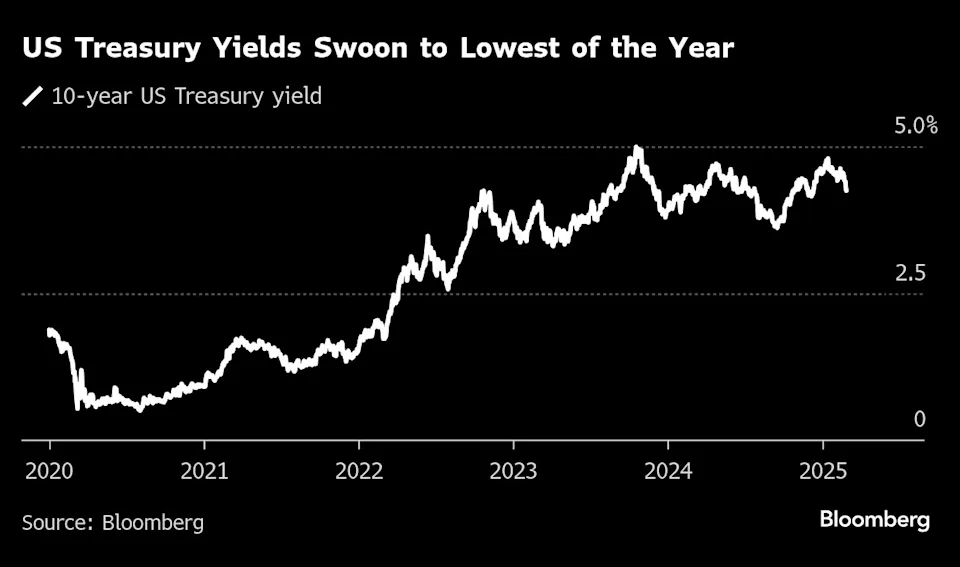

That sentiment helped drive Treasuries to gain for a sixth straight session, which has pushed yields to their lowest levels of the year. Meanwhile, strategists at Morgan Stanley say the 10-year tnx (^TNX) has scope to fall back below 4% if the prevailing view on the Fed shifts somewhat.

Traders this week resumed fully pricing in two quarter-point cuts by the Fed this year, and most of a third one next year, to a level of about 3.65%. Morgan Stanley says if the market prices in a drop to 3.25%, the 10-year can breach 4%. The bank expects inflation data to be released Friday — the prices indexes for January personal consumption expenditures, or PCE — to show a decline in the pace of price growth that could be decisive.

All three of this week’s fixed-rate Treasury auctions drew strong demand, concluding with Wednesday’s seven-year note sale. The $44 billion auction drew 4.194%, lower than its 4.203% yield in pre-auction trading close to the bidding deadline, a sign that demand exceeded dealers’ expectations. Auctions of two- and five-year notes earlier this week produced similar results.

Source: FINANCE.YAHOO