- Mon - Sat: 8.00 - 18.00

- 411 University St, Seattle

- +1-800-456-478-23

Capital Investment

- Home

- Our Services

- Capital Investment

Capital Investment

Our Capital Investment strategy is designed to solve sponsor equity needs with non-dilutive debt Provides non-dilutive debt for equity needs (growth, transitions) Allows Sponsors to tap the net asset value of a fund to obtain “off-market” debt financing for their portfolio companies Unlocks the value of older funds beyond their investment period

How we do it:

-

- – Loans supported by unsecured fund-level guarantee

-

- – No undrawn LP capital is required

JFSF Eventos Ltda provides senior, and junior loans to companies supported by a backstop from a financial sponsor (Private Equity funds, VC funds or Family Offices). The team works closely with sponsors to find creative solutions to provide non-dilutive financings to their portfolio companies to finance growth/change in lieu of using equity.

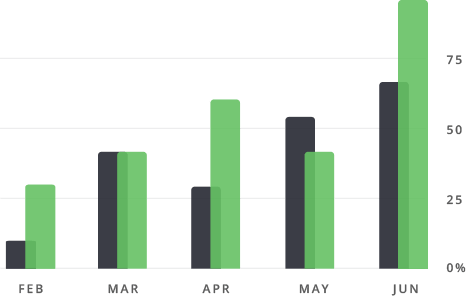

75

marketing analysis

65

business innovation

90

finance strategy

We are Always Ready to Assist Our Clients

developing financial processes and procedures

How It Works & How We Do It

Our specialists are ready to provide an analysis of both the market as a whole and its individual components (competitors, consumers, product, etc.), using practical methods and starting from your research goals.

- the organization is just beginning to operate in the market, implementing some projects. Our team of global experts help you achieve sustainable, organic growth by focusing on three critical building blocks.

- there are projects that require temporary expansion of the marketing department. Customer-focused businesses build a virtuous cycle we call the "customer wheel." We help you at every stage of growth, developing custom solutions and collaborating with all levels of your organization.

- there are projects that require temporary expansion of the marketing department. Align your marketing and brand strategy with overarching business objectives. We help you combine hard metrics with creative.

“I cannot give you the formula for success, but I can give you the formula for failure. It is: Try to please everybody.” david oswald

Business Planning & Strategy

Nurture promoters, your loyal customers who are more profitable and will advocate for your business—both in good times and bad.

Customer-focused businesses build a virtuous cycle we call the “customer wheel.” We help you at every stage of growth, developing custom solutions and collaborating with all levels of your organization. Identify quick, targeted customized solutions and operational improvements.